For example a bond that was issued at a face. That means the total expected future cash flow of your bond is 1500.

Accounting For Bonds Payable Principlesofaccounting Com

Bond premium the baseline amount is the amount of all remaining payments other than qualified stated interest.

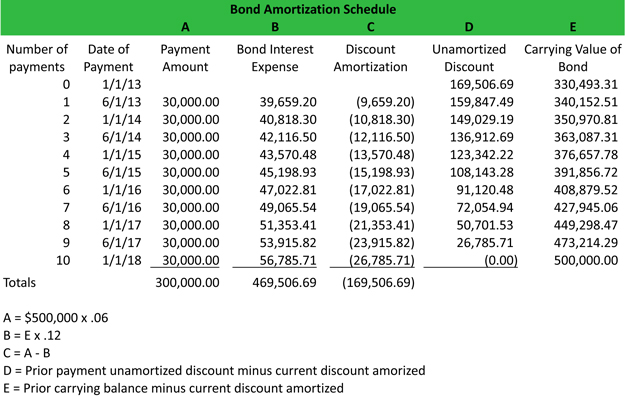

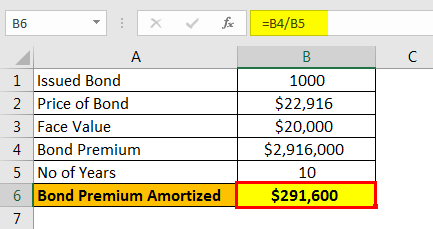

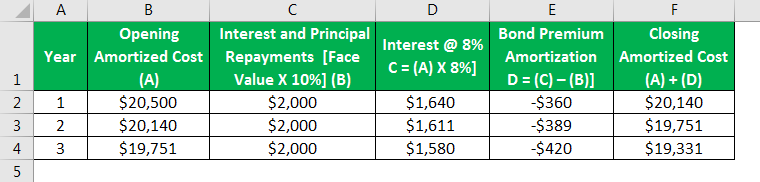

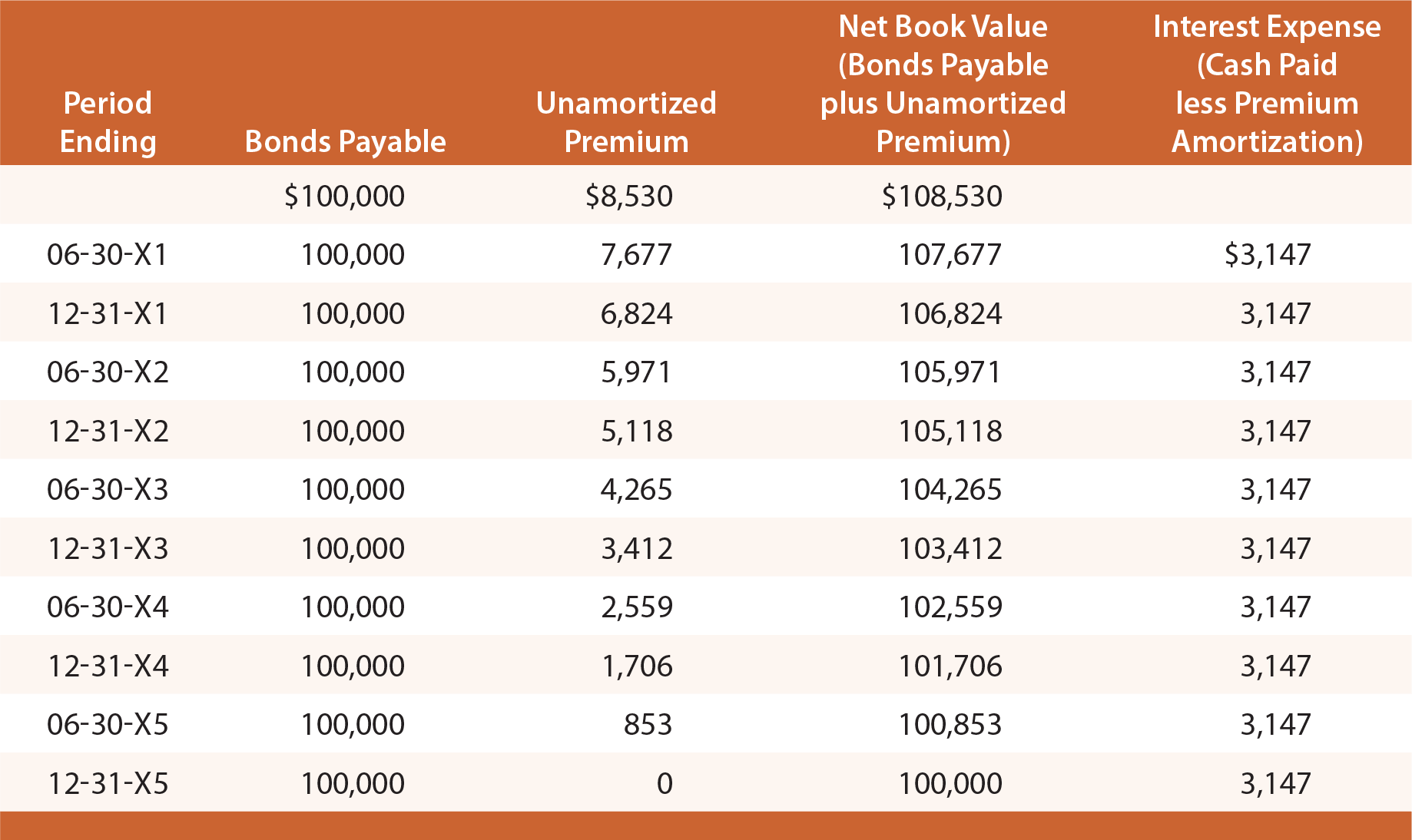

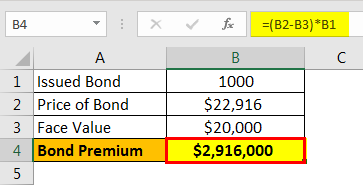

Premium bonds example. At the time of maturity the bondholder will still be repaid 2000. Example of Premium Bond Amortization Let us consider if 1000 bonds are issued at a price of 22916 having a face value of 20000. In our example the bond premium of 4100 must be reduced to 0 during the bonds 5-year life.

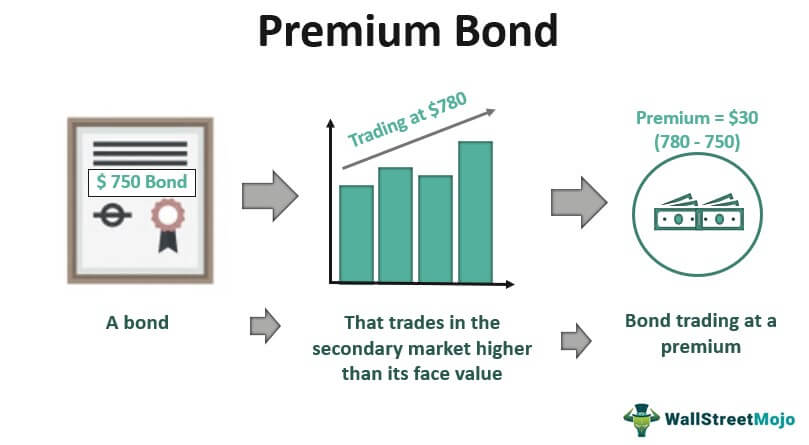

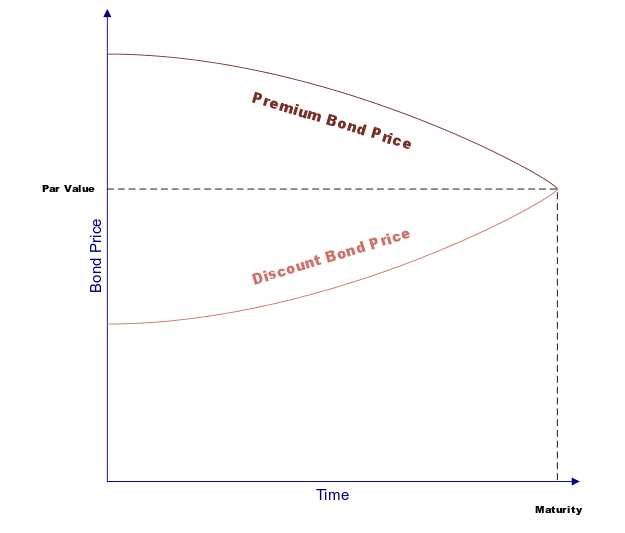

Premium Bonds Explained A bond thats trading at a premium means that its price is trading at a premium or higher than the face value of the bond. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. A premium bond is one that is worth more than the face value of the bond because interest rates in the market are below the interest rate that is currently being paid by the bond.

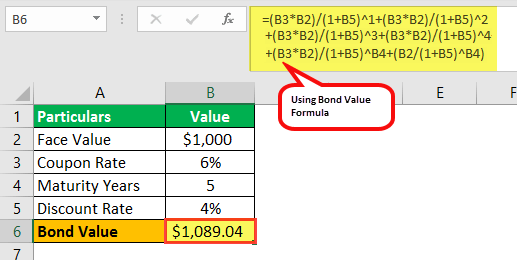

Every month the Premium Bonds are put into a monthly drawing to win tax-free prize money from 25 to 1 million. Bond Pricing Example. Are you a CPA candidate or accounting student.

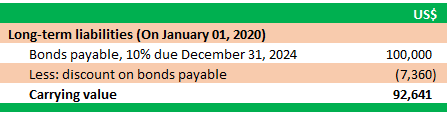

By reducing the bond premium to 0 the bonds book value will be decreasing from 104100 on January 1 2020 to 100000 when the bonds mature on December 31 2024. It means one bond will be able to exchange to five common stocks on the maturity date. To illustrate the premium on bonds payable lets assume that a corporation prepares to issue bonds with a maturity amount of 10000000 and a stated interest rate of 6.

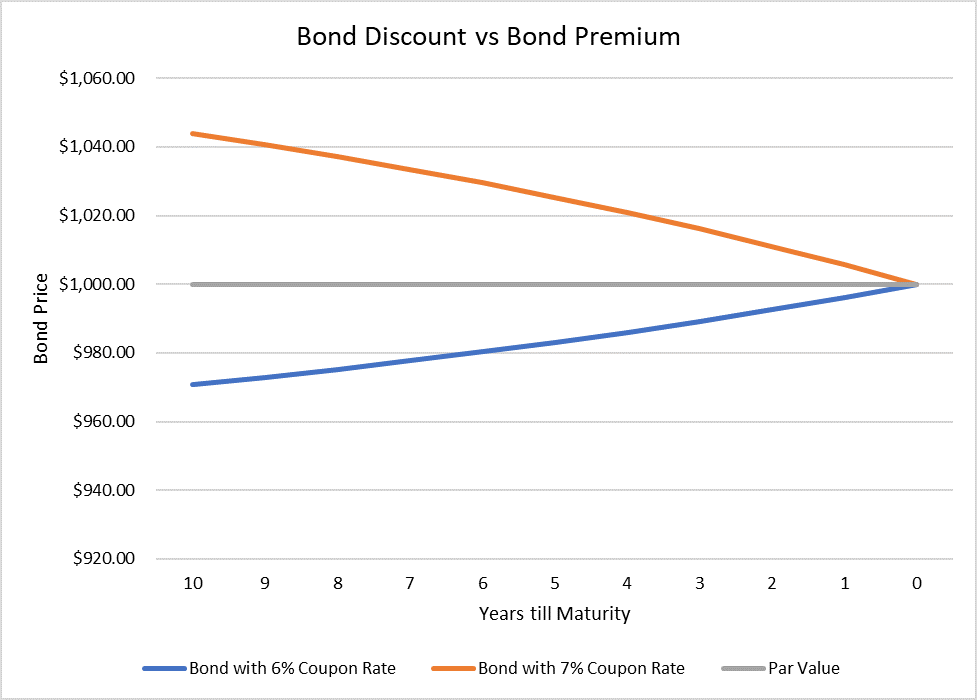

The amount by which the bond proceeds exceed the face value of the bond is the bond premium. A bond trades at a premium when its coupon rate is higher than prevailing interest rates. At the maturity date you will be paid back the 1000 par value.

Example For example lets say that you purchased a 1000 bond that paid a coupon rate of 4 percent. The Bond Premium will be Bond Premium 2916000. Using the previous example of a bond with a par value of 1000 the bonds price would need to fall to 750 to yield 4 while at par it yields 3.

NSI Premium Bonds Find out more about NSI. Since they do not expire you can still cash in old paper Premium Bonds if theyve been selected. The difference represents the bond premium.

Premium Bonds are a type of savings investment offered in the UK by National Savings and Investment NSI. For example a Bonds value. Continuing with the example above if the annual coupon rate is 7 instead of 6 and the market interest rate is 64 your bond will sell at 104382 raising a total amount of 5219 million.

This is because investors are willing to pay more for the bonds higher yield. Every 1 you invest buys a unique Bond number with a separate and equal chance of winning in a monthly prize draw. Company issue 8 convertible bond with par value of 1000.

Bonds will be issued at par value when the coupon rate equal to market rate there is no discount or premium on bond. For market discount the baseline amount is the Bonds adjusted issue price. The bond will return 5 50 per year.

A bond that is trading above its par value original price in the secondary market is a premium bond. It equals 219 million. Say you purchase a bond for 1000 present value.

Resultantly older bonds start trading at a premium in the secondary market. For example if a bond with a 2000 face value and 10 coupon rate is trading at 2200 it is a premium bond. The bond has a par value of 1000 a coupon rate of 5 and 10 years to maturity.

However the bondholder will still get 200 interest as mentioned in the bond contract. Bond premium and market discount arise because of market price changes. However when the 6 bonds are actually sold the market interest rate is 59.

A bond trades at a discount when its coupon rate is lower than prevailing interest rates. Bonds Issuance at Par Value Example On 01 Jan 202X Company A issue 6 bond at par value of 100000. The bonds will be matured in 3 years.

The bond will be converted to common stock on the maturity date at rate of 15. At the end of 2 nd year the bonds market price is 1100 while the market price of. A bond will trade at a premium when it offers a coupon interest rate that is higher than the current prevailing interest rates being offered for new bonds.

And with NSI Premium Bonds your money is 100 safe as were backed by HM Treasury.

Premium Bonds Definition Overview Valuation Calculations

Premium Bonds Definition Overview Valuation Calculations

What Is The Effective Interest Method Definition Meaning Example

What Is Discount Bond Pros Cons Fincash Com

Amortization Of Bond Premium Step By Step Calculation With Examples

Premium Bonds Definition Overview Valuation Calculations

Bond Issued At Discount Versus Premium How To Calculate And Amortize The Bond Youtube

Journal Entry For Bonds Accounting Hub

Amortization Of Bond Premium Step By Step Calculation With Examples

Chapter 7 Interest Rates And Bond Valuation Ppt Video Online Download

Accounting For Bonds Payable Principlesofaccounting Com

Journal Entry For Bonds Accounting Hub

Amortizing Bond Premium Using The Effective Interest Rate Method Accountingcoach

Amortizing Bond Premium Using The Effective Interest Rate Method Accountingcoach

Amortizing Bond Discount Using The Effective Interest Rate Method Accountingcoach

Bond Discount And Premium Calculation Example

Amortization Of Bond Premium Step By Step Calculation With Examples

Amortization Of Bond Premium Step By Step Calculation With Examples